Many companies have started providing advertisements through different channels and Google does it with the help of YouTube. Alphabet is leading the market with the help of NASDAQ GOOG at https://www.webull.com/quote/nasdaq-goog and NASDAQ GOOGL stock. Other market leaders in this field are Facebook and Amazon. Google face many adversities in the decade of 2010s but still, it has grown its bribes and now is the owner of billions of dollars. From January 2010 to December 2019, the earning of the company grew by 405%. Google opened its holding company named Alphabet, which helped the company to grow more as it bifurcated its shares into class A, B, and C. The conditions have been changed due to covid-19 and people have been asked to purchase the shares of the company and keep it on hold. Here are the reasons.

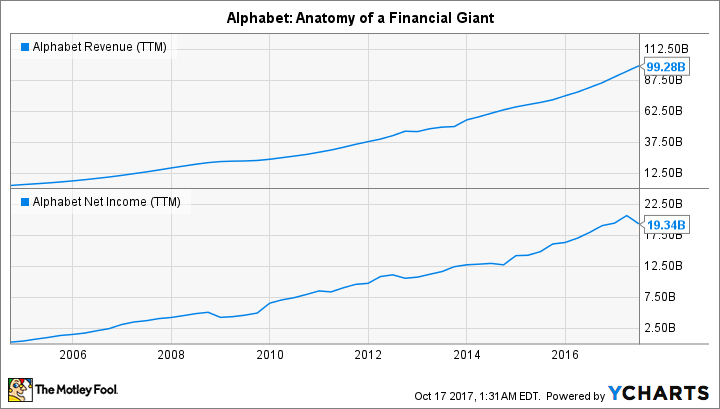

Revenue of the company is growing at a fast rate

The first thing that brings revenue to the company is searching which is done by millions of people. Google has covered up more than 70% of the market. Another source of revenue for this company is advertising which it does with the help of YouTube channels and other sources. The growth if the company was 20% in 2018 and 2019.From the past few months, the growth slowed down due to coronavirus. But now the company has started growing again. Google has taken advantage of being a dominant company in the search engine market so now it has plans to move the advertising industry from TV to online.

Since the mobiles are available at a very low cost and it has reached to a large number of people. Internet has also reached due to low cost of recharges so Google has the opportunity to capture more markets especially in the developing countries.

Margins and balance sheet

Alphabet has shown that it has the cash of $121 billion and it has shown this in its balance sheet. It has also shown that the company has the debt of $4 billion. Because of such a balance sheet, the company can make investments anywhere it likes. The main area where it likes to make investment is research and development. It wants to invest money so that it can develop new services and products for its customers. The company can use its cash for buying back the shares. Alphabet has maintained and managed the profit margins of the company. Due to this maintenance, the profit margin of the company has risen by 20% for the past three years.

In all it can be said that if people purchase GOG shares and keep them on hold, they can get good amount of profit. You can check more information at https://www.webull.com/newslist/nasdaq-goog.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.